National Income is part of the IB Syllabus for macroeconomics as well as the syllabus for AP Macroeconomics for measurement of economic performance

Circular flow of income[]

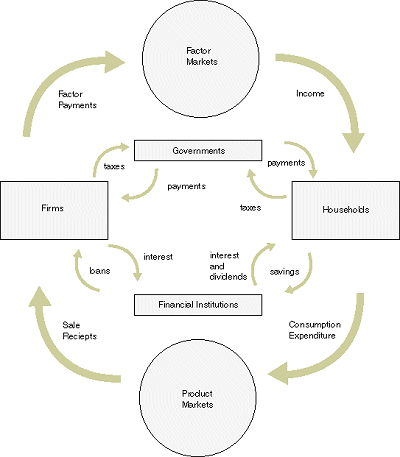

The circular flow model shows how money moves through an economy between businesses, individuals, and other institutions. Since there is a constant flow of money within an economy, the Circular Flow of Income is considered a flow variable (it depends how long you are looking, studying, or observing that given variable.) Individuals work for income, then spend their income by consuming goods and services from businesses, paying taxes, and investing in the stock market. Businesses use the money spent by individuals' consumption and the money raised by selling stock to run their businesses, (i.e., purchasing materials to produce manufactured products and paying employees). All spending from individuals becomes the income of the businesses, and the spending of the businesses become the income of the individuals.

While all this is happening, the government collects taxes from incomes, sales, etc. to generate money that they then inject back into the economy as government spending (this includes paying government employees, government-run programs, etc.). Individuals and businesses both are able to invest their money in stocks, or put it in a bank to let it collect interest. The banks use these investments to make their own profit by loaning money from investments out to individuals and businesses, then charging interest on the loans. Income could be spent on foreign goods, but foreigners could spend their income on the domestic country's goods and services as well, so the Circular Flow Model is still considered a closed system.

The Circular flow of Income

== Methods of measurement==

• Income: National income is the total income earned by U.S. citizens and businesses, regardless of location or residence

National Income = compensation to employees+proprietors' income+corporate profits+rental income+net interest

Personal Income is the amount of income that individuals actually receive.

Personal Income = National income-Undistributed corporate profits-social insurance taxes-corporate profit taxes+transfer payments

Disposable income is the portion of personal income that can be used for consumption or saving.

Disposable Income = Personal income-personal taxes

• Expenditure

(GDP= Consumption + Government Spending + Investment + Net Exports - Imports=C + G + I + (X - M)

• Output: The output method =

The value of final output produced by various industrial sectors.

Different Measures of National Income[]

Gross vs. Net:

Gross is the total of something (such as sales, profit, salary, etc.) before deductions, such as taxes, have been factored in. Net is the total after deductions have been made, such as salaries after taxes.

National vs. Domestic:

National income is the income that is earned by the people of a country which includes both labor and capitol investments. Domestic income is the income that is earned by the entire country as a whole including income from the goods and services sold by the country.

Nominal vs. Real:

Nominal measures numbers or figures without factoring the effects of inflation, whereas real numbers and figures accounts for the effect of inflation. Nominal has to do with the value in the amount of money, real has to do with the value after the adjustments are made for inflation. This difference must be understood while comparing things such as GDP in the same country from two different years. For example, real interest rates = nominal interest rates - rate of inflation.

Total vs. Per Capita:

The difference in total and per capita is that when calculating per capita the total is divided by the population of the domestic country. This is done so that the GDP value accurately reflects how much of the total can be accounted for by a single person. For example, if a country of 10 people makes $600, the total is $600 and the per capita value is $60 ($600/10=$60). This is done because the total has no reflection of the amount of people in a situation. For instance, if all 100 people in Country X make $1000 and the single person in Country Y makes $1000, there is no way to tell from the total which country has people that are better off, but with the per capita data, you can see that the person is Country Y is significantly better off then those in X, ceteris paribus. When comparing two countries you must also compare the Purchasing Powers of the two countries.