An oligopoly is much like a monopoly , in which only one company exerts control over most of a market . In an oligopoly, there are at least two firms controlling the market. Similar to a monopolies there are high barriers to entry because a small proportion of producers control most of the market.

Collusive and non-collusive oligopoly[]

Collusive oligopolies exists in many forms, but the most common method of collusion is when the firms set identical prices on a product. They also divide the market into other regions that basically creates regional monopolies. The main idea of collusion is that oligopolistic firms don't want to face head on competition that could harm their profits. Note that collusive oligopolies tend to be unstable, as there is usually benefit to be had for one firm to "betray" the others.

Non collusive oligopoly exists when the firms in an oligopoly do not collude (cooperate) and so have to be very aware of the reactions of other firms when making price decisions.

Cartels[]

Cartels are collusive agreements taken to the extreme. A cartel acts to increase profits by setting output, or price, by dividing the market between firms. The aim is to avoid competition and act as one firm. This turns the colluding oligopoy into a monopoly. (Cartels are usually hard to maintain because the members of the cartel are sometimes tempted to cheat and earn profits for themselves.) An example of a real-life cartel is OPEC, the Organization of Petroleum-Exporting Countries.

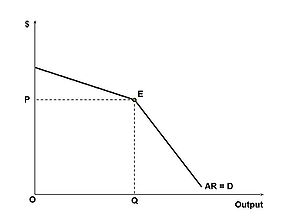

Kinked demand curve[]

An oligopolist faces a downward sloping demand curve but the elasticity may depend on the reaction of rivals to changes in price and output. Assuming that firms are attempting to maintain a high level of profits and their market share it may be the case in one of two ways:

1. Rivals will not follow a price increase by one firm, therefore demand will be relatively elastic and a rise in price would lead to a fall in the total revenue of the firm.

2. Rivals are more likely to match a price fall by one firm to avoid a loss of market share. If this happens demand will be more inelastic and a fall in price will also lead to a fall in total revenue.

Importance of non-price competition[]

Non-Price competition in oligopolies is important because there are other qualities of a good that make the demand for this good rise. Reasons would be:

'Quality or Innovation': The product itself--how it looks

Enhanced perceived value: What company makes people believe about the product.

Loyalty to the brand: People would buy because they like the company that made it.

For example: let's take a BMW and a Chevy automobile. If the BMW were more expensive than the Chevy, people would buy the BMW for the following reasons: the car is better and runs nicer than a Chevy--quality or innovation. People would believe that the car runs nicer and works better--enhanced perceived value. The customers buy BMWs because they are loyal to the brand. If people buy products just because it's cheap, they might not check the other qualities of the good and make a big mistake.

Theory of contestable markets[]

An economic concept that refers to a market in which there are only a few companies that, because of the threat of new entrants, behave in a competitive manner. The market theory assumes that even in a monopoly or oligopoly, the existing companies will behave competitively when there is a lack of barriers, such as government regulation and high entry costs, to prevent new companies from entering the market. Considerable criticism surrounds this theory because there are often large entry and exit costs associated with entering a market.